For customers who wish to pick up cash from their residences or offices where proper KYC procedures have to be fulfilled, PNB offers doorstep banking services. For the filing of their digital life certificates, senior citizens can also use a doorstep service.

No matter where their Aadhaar-linked pension or savings account was started, pensioners can also submit DLCs at any PNB branch. Pensioners can also submit their DLCs at PNB branches if they receive their pension from another bank or treasury.

Additionally, retirees can create digital life certificates at home by downloading a Jeevan Pramaan submission application.

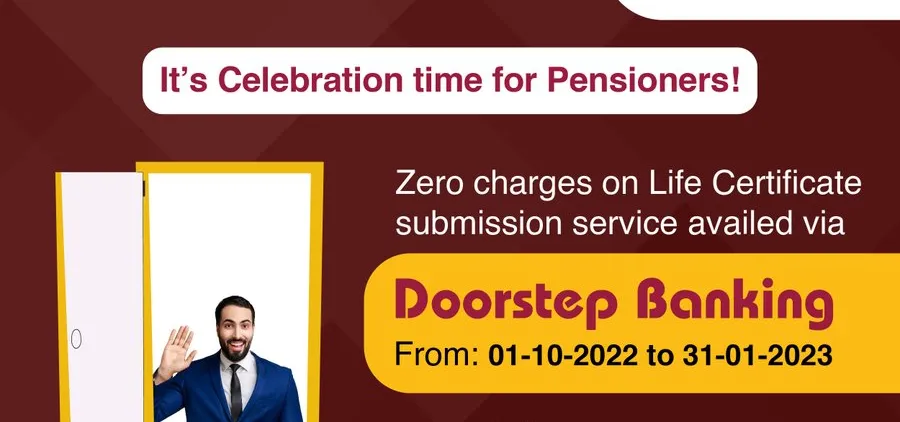

According to the latest tweet by PNB, “Pensioners get the best surprise gift this year! Submission of life certificate is now free through Doorstep Banking Service from 1-10-2022 to 31-01-2023.”

An elderly citizen, a person with a disability, and other clients had to pay the service fees. According to the PNB website, the fee for picking up a life certificate from a pensioner or family pensioner was Rs 60 + GST.

According to the PNB Doorstep banking procedure, “A fall-back request of Life Certificate is undertaken in the event of failure of obtaining fingerprints of the pensioner during submission of Digital Life Certificate.”

Here is the procedure to submit your Digital Life Certificate at Punjab National Bank:

Pensioners can generate DLC by visiting any branch of Punjab National bank PAN India. Aadhar number and Pension account must be connected for DLC at the bank level to be accepted.

At the bank, the pensioner must present their name, Aadhar number, and mobile number. Pensioners must then provide biometrics when NIC sends an OTP to their mobile device.

The bank shall receive self-declared pension-related information such as PPO number, pension account, name of pension sanctioning authority, and name of the pension disbursing authority.

A pensioner receives an acknowledgment SMS from NIC as soon as the DLC is submitted. However, within two to three days of DLC submission, only the Punjab National bank will be able to confirm the real acceptance or rejection of the DLC.

Digital Life certifications may be denied by PNB for one of two reasons:

if the pensioner's correct Aadhaar number is not updated in PNB databases.

if the pensioner or officials provided an inaccurate account number when submitting the DLC.

Pensioners receive confirmation from PNB on their registered mobile number within two to three days of the DLC being processed at the bank, accompanied by the required notes or justification.

If the DLC was rejected, the pensioner must resubmit their life certificate and get the problem fixed that was earlier conveyed through SMS remarks.